Actuarial Program

What is an Actuary?The most asked question when people hear the word “Actuary”.

“Actuaries put a price tag on future risks.”

An actuary is a business professional who analyzes the financial consequences of risks. Actuaries use mathematics, statistics, and financial theory to study uncertain future events – especially those of concern to insurance programs. Actuaries may work for insurance companies, consulting firms, governments, banks and investment firms, or in businesses that need to manage financial risk.

A career as an Actuary is best described as a “business” career with a mathematical basis, because of their unique combination of analytical and business skills.

Actuaries make a difference. Their calculations and projections are the backbone of the insurance and financial security industries. Actuarial work involves lots of math, but actuaries must also be up-to-date on business issues and trends, social science, law, and economics. In other words, actuaries have a well-rounded business approach to problem solving. They also need to be good communicators to explain things to non-actuaries.

“Actuaries are highly sought-after professionals who develop and communicate solutions for complex financial issues.”

Actuaries describe their work as challenging yet interesting, fast paced yet low-stressed, and dynamic yet with a good work-life balance. It has been consistently rated as one of the Top 10 jobs on a variety of factors.

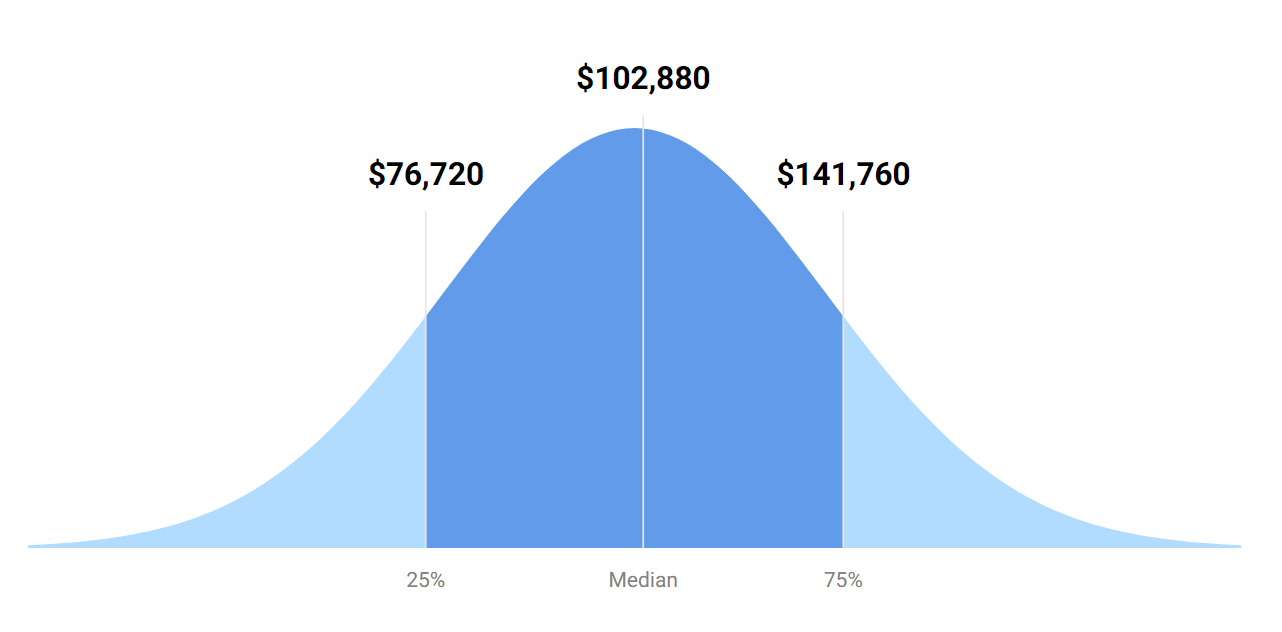

According to several studies, the profession is more open than others to women and members of under-represented minority groups. Actuaries are in high demand, with starting salaries ranging from $60,000 to $75,000. The salary increments are based both on experience and exams passed. The increments can be quite large and many actuaries earn in the triple digits.

Quick Facts about Actuaries

Work Environment

Although most work full time in an office setting, some actuaries who work as consultants may travel to meet with clients.

Job Outlook

Employment of actuaries is projected to grow 20% from now to 2028, much faster than the average for other occupations.

Designation

There are around 9 professional qualification exams which culminate in an FSA or FCAS credential. It takes 6-8 years to pass all of the exams.

“You are self-motivated, goal oriented, and have superior math aptitude and communication skills – consider being an Actuary!”

Insights on Curriculum:

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.